2025 U.S. Board Index

In a complex business environment, board composition continues to evolve, with boards now showing a greater preference for directors who have seasoned experience. For the past 40 years, our firm has studied the composition, governance practices and refreshment trends of boards across the S&P 500. The long-running nature of our research gives us a unique perspective on how boards have evolved from compliance-focused bodies to strategically engaged stewards guiding long-term value.

Yet amid rising complexity and uncertainty, boards are racing to keep pace. Another 2025 Spencer Stuart study found that only 22% of CEOs report receiving effective board support to navigate today’s challenges. Similarly, only 43% of CEOs said that their board directors have specific subject-matter expertise aligned with the company’s most pressing issues, compared with 63% of directors.

In this environment, boards are recalibrating their composition, prioritizing directors with experience — seasoned leaders able to serve as strategic partners to management. And this year’s incoming class reflects this shift; as a whole, they are older, most likely to be retired and to have served on a public board previously, and more likely to have a background as a CEO or financial executive.

Here are the highlights from our annual analysis of the latest S&P 500 proxy statements, examining board composition, governance practices and director compensation trends.

Board refreshment is down compared with previous years

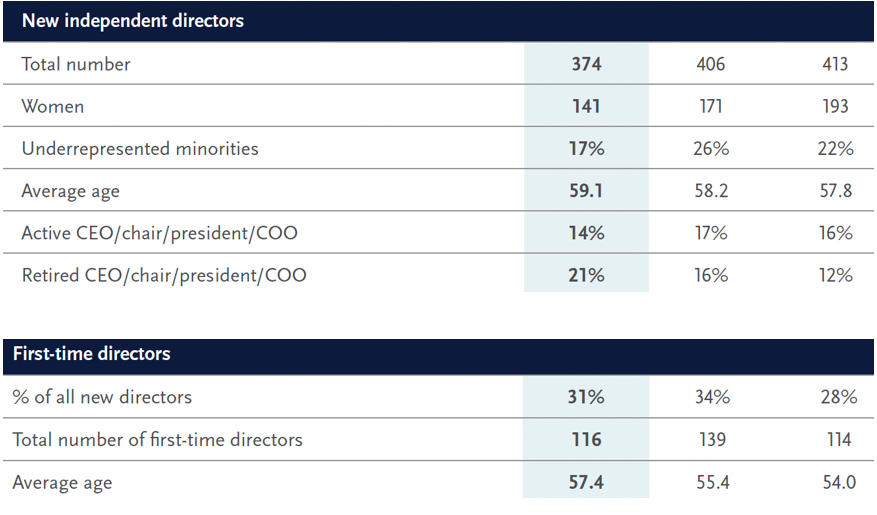

- S&P 500 boards appointed 374 new independent directors in 2025, an 8% decrease from last year and the lowest number since 2016. Average annual turnover is now 0.8 new directors per board. However, the year-over-year decline reflects a longstanding pattern, with new director appointments approximating the prior year’s number of director departures (374 last year).

- Only 50% of S&P 500 boards appointed a new independent director this year (down from 58% in 2024).

- Two-thirds of boards have mandatory retirement policies, a decline from 2015, when 73% had such policies in place. Of those with mandatory retirement policies in place, 64% set the age at 75 or older, and that share has nearly doubled since 2015 (34%).

Proven executive experience is in demand

- Among incoming directors joining boards in 2025, 30% are active or retired CEOs, and 29% have financial experience, both in line with 2024.

- New appointees this year skew older, with an average age of 59.1, compared with 58.2 in 2024. First-time directors skew younger, but the average age of first-time directors in the class of 2025 has also increased, from 55.4 years to 57.4 years.

- New appointees are more likely to be retired (59%), an increase of 11 percentage points compared with 2024.

- The number of first-time directors declined to 31% of all incoming appointments, from 34% in 2024.

- The share of next-gen director appointments (people aged 50 or younger) declined to 11%, from 14% in 2024.

Financial and P&L leadership backgrounds are more common

- 29% of incoming directors have financial backgrounds, and 25% have functional or profit-and-loss leadership roles. Although those numbers have been relatively flat in recent years, they have increased from 21% and 18% 15 years ago, respectively.

- Among industry backgrounds, technology/telecommunications continues to be the most common, constituting 16% of new appointments in 2025, followed by industrials/manufacturing (14%), consumer goods and services (14%) and financial services (12%). All are unchanged this year.

Gender and racial/ethnic representation has plateaued after steady increases

- The share of new director appointments filled by executives self-identifying as female, Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, or two or more races or ethnicities, and/or LGBTQ+ declined in 2025 to 46% from 59% in 2024 and 68% in 2023. Despite the dip, representation remains higher than a decade ago: 42% in 2015.

- Women represent 38% of new directors in 2025, down from 42% in 2024 and continuing a decline from a peak in 2020.

- People from an underrepresented racial or ethnic group represent 17% of new directors, in line with the level of a decade ago (18%).

- Overall, 50% of all S&P 500 directors identify as women and/or from an underrepresented racial or ethnic group; that number is unchanged from 2024.

- One quarter (25%) of S&P 500 directors are from an underrepresented racial or ethnic group, 35% of all directors are women.

- More than half of all boards (58%) use Rooney Rule-type policies that require the consideration of candidates from a diversity of backgrounds when filling open director positions.

Independent board leadership is growing

- 61% of boards now separate the chair and CEO roles, up from 48% in 2015 and 27% in 2004.

- Independent chairs are more common as well, rising to 42% of boards today, up from just 9% of companies in 2004.

- With an increase in independent chairs, the use of lead or presiding directors has declined: At its peak in 2006, 96% of boards had a lead or presiding director; today, that has decreased to 61%.

Boards are more systematic about assessing and disclosing their performance

- Virtually all boards (99%) report conducting some type of annual performance evaluation. Roughly one-fourth (27%) disclose working with an independent third party to facilitate the evaluation process.

- Eighty percent now disclose a director skills matrix — more than double the share in 2020 (38%).

Director compensation is rising

- Average pay increased 3% to $336,352, keeping pace with inflation. Compensation mix: 59% stock awards, 36% cash. Independent chair premiums average $172,867, with lead/presiding directors at $51,011.

More boards are limiting additional director activity

- Most S&P 500 boards (86%) report a limit on directors accepting other public company directorships — up from 84% last year and 77% a decade ago.

- Just over eight in 10 boards (81%) report having a numerical limit for public corporate directorships applicable to all directors, up from 77% in 2024.

- Like last year, most of these policies limit directors to three or four additional public directorships.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.